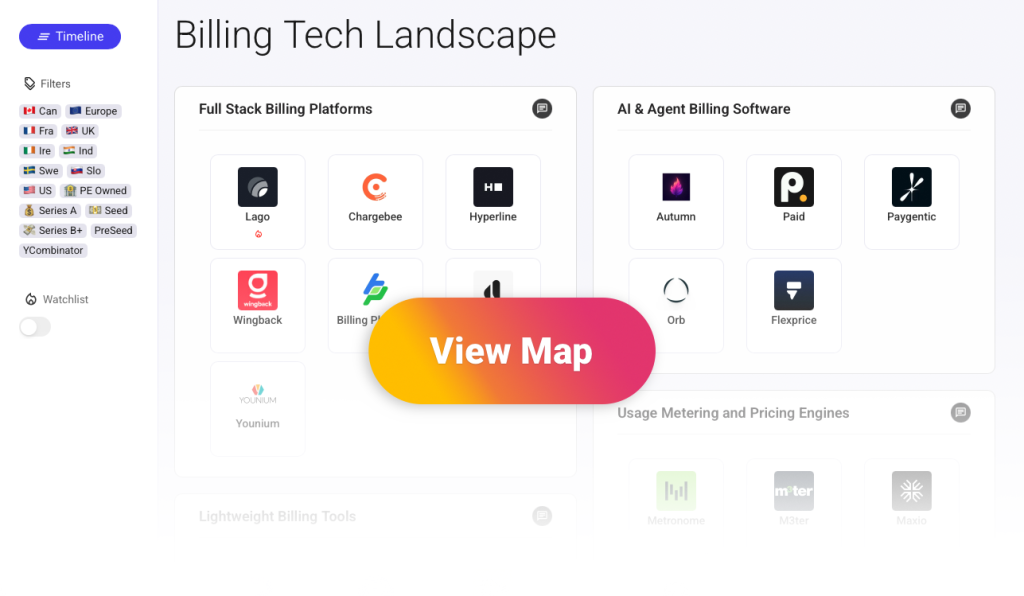

This post is part of a series covering the billing tech startup landscape. You can view the full interactive map with more than 20 startups here.

The mapping above covers the new generation of billing tech for B2B software. The goal is to illustrate see how this market is evolving, compare the different approaches adopted by founders and discover the players shaping the future of software pricing.

Full Stack Billing Platforms

What is the scope of core billing platforms?

These platforms manage the full revenue cycle for software companies:

- Subscription lifecycles: Create plans, manage upgrades or downgrades, control renewals and deal with cancellations.

- Invoicing and payments automation: Generate invoices, collect payments, manage taxes and support multiple currencies.

- Usage metering: Ingest raw product events, validate them, enrich them and aggregate them into a clean usage stream that billing and pricing systems can rely on.

- Unify pricing models: Support flat subscriptions, seat based pricing, usage add ons and hybrid models in one system.

- Customer accounts management: Track contracts, balances, credits and customer history across billing periods.

- Finance and CRM systems integration: Sync with ERPs, accounting software and CRM tools to close the loop between sales, billing and finance.

- Revenue workflows: Support revenue recognition, dunning, collections and audit trails needed for compliance.

Why did a new generation of full stack billing platforms emerge in the past couple of years?

- Developers want systems they can actually integrate: The move toward API first and developer friendly software opened space for open source and engineering centric billing platforms.

- The shift to hybrid pricing created new needs: SaaS companies now mix subscriptions, seats, credits and usage, which exposed limits in older billing systems.

- Modern products generate richer billing events: AI and API based businesses need flexible pricing infrastructure that can evolve fast, pushing founders to build new solutions.

- Finance teams want cleaner workflows: Traditional tools often require spreadsheets and manual steps. New entrants promise automation and a smoother quote to cash path.

7 Full Stack Billing & Pricing Tech Startups

🇪🇺 Europe – 🇫🇷 Fra – 💰 Series A – YCombinator

What they do:

- They provide a billing platform that manages metering, subscriptions, usage based pricing, credits and invoicing for software companies. It supports simple and complex pricing needs.

- The system collects usage events in real time. Companies can charge based on consumption such as API calls or data volume.

- It supports mixed monetisation models. A business can combine subscription revenue with elastic usage billing or prepaid credits.

- It is built for engineering driven teams that want full control over pricing logic and billing workflows.

Company specificities:

- The product is open source and self hostable. This gives teams strong control over their billing engine and avoids lock in.

- Its architecture is event based and handles high throughput which fits companies with heavy usage patterns.

- It is designed for developers with strong API coverage and flexible integration paths.

- It targets modern monetisation strategies beyond simple subscriptions which makes it attractive for SaaS, cloud and AI platforms.

🇺🇸 US – 💵 Seed – YCombinator

What they do:

- They provide a billing and monetisation platform built for B2B SaaS companies. It supports mixed pricing models such as usage based, per seat and feature based plans.

- Teams can create and update pricing plans without heavy engineering work. They can manage entitlements and track usage with clear metrics.

- It offers a self service billing portal that lets customers upgrade or downgrade on their own. They can also view their usage in real time.

- The system automates invoicing by combining plan rules, recorded usage and discounts which helps finance teams reduce errors.

Company specificities:

- The platform is designed specifically for SaaS monetisation. It focuses on flexibility in pricing rather than only classic recurring subscriptions.

- It presents itself as a full monetisation stack for SaaS companies. Pricing creation, billing and revenue operations sit in one place.

- It supports both product led and sales led motions which helps unify simple signups and large enterprise deals.

- It includes integrations for payments, taxation and global billing requirements so companies can expand without rebuilding billing logic.

🇺🇸 US – 💵 Seed – YCombinator

What they do:

- They provide a platform for B2B SaaS and fintech companies that unifies pricing, quoting and billing in one place. It helps teams manage the full path from quote to revenue.

- The system automates pricing configuration, quote generation, invoicing and revenue tracking. This removes the need for spreadsheets or disconnected tools.

- It supports flexible monetisation models such as subscriptions, usage based billing and credit based plans.

- The product aims to reduce revenue leakage and simplify collaboration between sales, finance and product teams.

Company specificities:

- They emphasise speed and agility. Pricing changes or model adjustments can be launched quickly without heavy engineering involvement.

- They position themselves as a central monetisation engine rather than only a billing or quoting tool.

- They are a young YC backed company focused on fast growing businesses that need flexible monetisation infrastructure.

- They design their platform around rapid market changes and AI driven pricing evolution which demand adaptable revenue systems.

🇪🇺 Europe – 🇫🇷 Fra – 💵 Seed

What they do:

- They provide a unified revenue management system that covers the entire path from quoting a deal to collecting cash.

- Their tool supports flexible pricing models including subscriptions, usage based billing and enterprise contracts.

- They enable sales teams to generate and manage quotes, finance teams to automate invoicing and payments, and engineering teams to avoid building custom billing logic.

- Their system offers global compliance and multi currency capabilities so companies can scale internationally without billing friction.

Company specificities:

- They emphasise high flexibility in pricing: companies can iterate pricing models quickly without major engineering work.

- They position themselves as a “system of record for revenue” rather than a simple billing tool, bringing together revenue operations, finance and product workflows.

- They support deep integrations with CRM, payment, analytics and ERP systems so all teams stay aligned and data flows are consistent.

- They are built for modern business models (for example hybrid subscription + usage) and aim to solve complexity that legacy billing platforms struggle with.

🇮🇳 Ind – 💸 Series B+

What they do:

- They offer a platform that automates recurring billing, subscription management and invoicing. It supports both simple and complex revenue models.

- The system handles many pricing structures. Companies can run flat fees, tiered plans, usage based pricing or mixed models.

- It supports international operations with multiple currencies, payment methods and tax rules which helps businesses expand globally.

- It includes analytics, revenue recognition tools and retention workflows to streamline finance and growth operations.

Company specificities:

- The platform serves both early stage companies and large enterprises. It scales from basic setups to advanced global revenue operations.

- It provides strong API and integration capabilities so teams can customise billing logic and connect it with their internal systems.

- It supports modern consumption based models in addition to traditional subscriptions.

- It focuses heavily on compliance and financial accuracy which is important for companies with global billing complexity.

🇺🇸 US – 🏦 PE Owned

What they do:

- They offer a platform that automates the full revenue cycle. It covers quoting, billing, payments and collections.

- They support complex monetisation models such as subscriptions, usage based plans, hybrid pricing and configurable packages.

- The system handles global billing needs with multi currency support, tax compliance and varied payment methods.

- It provides analytics and forecasting tools that help finance teams track revenue, recognise revenue correctly and improve cash flow operations.

Company specificities:

- The platform is built for enterprise scale. It is designed to manage large and complex billing environments.

- It offers a flexible data model and configuration approach so teams can tailor workflows and pricing logic without heavy engineering work.

- It connects deeply with finance and order to cash systems which makes it part of a broader revenue operations stack.

- It includes revenue recognition and receivables automation which are features aimed at mature finance teams.

🇪🇺 Europe – 🇸🇪 Swe – 💵 Seed

What they do:

- They provide a platform for subscription management, billing and revenue operations focused on B2B SaaS and tech companies. It centralises recurring and usage based billing.

- The system handles many pricing structures such as flat fees, tiered models, volume pricing, milestone billing and metered usage.

- It supports global operations with multi currency invoicing, tax compliance and integrations with finance and CRM or ERP systems.

- It offers real time subscription metrics and reporting so teams can track growth, churn and financial performance.

Company specificities:

- It is built for companies with complex subscription setups. It supports hybrid models and advanced billing logic for mature SaaS businesses.

- The platform covers the full quote to cash chain including contract creation, activation, billing, revenue recognition and reporting.

- The company has strong European roots and is now expanding internationally.

- It places emphasis on financial accuracy, auditability and compliance which matters for organisations with sophisticated finance teams.