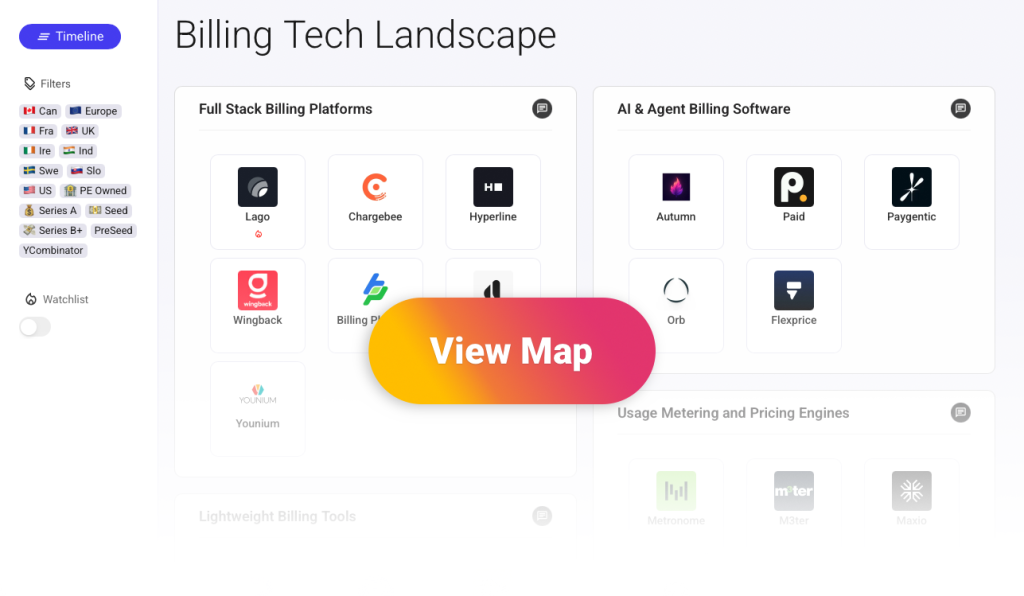

This post is part of a series covering the billing tech startup landscape. You can view the full interactive map with more than 20 startups here.

The mapping above covers the new generation of billing tech for B2B software. The goal is to illustrate see how this market is evolving, compare the different approaches adopted by founders and discover the players shaping the future of software pricing.

Lightweight Billing Tools

What is the scope of lightweight billing tools?

- They focus on simple billing needs: These tools handle basic subscriptions, invoices or pay as you go charges without long configuration.

- They offer fast adoption: Small SaaS teams or indie developers can set up billing in minutes with minimal integration work.

- They streamline checkout and payments: They often provide ready made payment flows, customer portals and credit card processing through embedded payment providers.

- They minimise operational overhead: They avoid complex workflows and expose only the essential features needed to accept and track payments.

How do they differ from core billing platforms?

- They do not cover the full revenue lifecycle: Full stack platforms manage renewals, revenue recognition and multi entity accounting, while lightweight tools keep only essential workflows.

- They avoid heavy configuration: Core platforms support hybrid pricing, complex discounts and advanced usage. Lightweight tools focus on simplicity rather than depth.

- They target smaller teams: Core billing is usually chosen by scale ups or enterprise SaaS. Lightweight tools target early stage founders and solo developers.

- They have narrower integration surfaces: Core platforms integrate with ERPs or CRMs. Lightweight tools mostly cover payment gateways and basic analytics.

5 Startups Providing Lightweight Billing Tools

🇺🇸 US

What they do:

- They provide a simple billing tool for freelancers and small businesses. It helps manage clients, send invoices and automate recurring charges.

- The platform supports automatic payments for repeat work so users reduce manual follow ups.

- It offers payment links that clients can use to pay quickly with common payment methods.

- It includes lightweight dashboards that show income trends and basic cash flow indicators.

Company specificities:

- It is designed for freelancers and very small teams. The product avoids complexity and focuses on ease of use.

- Setup is fast because it works with common payment providers and requires little configuration.

- The product keeps a minimal feature set which makes it accessible to non technical users.

- Its roadmap focuses on practical improvements for small operators rather than enterprise level features.

🇨🇦 Can

What they do:

- They provide a subscription billing and invoicing platform that helps companies set up recurring revenue models quickly. Setup is designed to take only a short time.

- The system supports recurring payments, add ons, extra charges and multi currency invoices which helps businesses sell across markets.

- It includes features such as automated customer notifications, credit notes, customer self service portals and basic analytics.

- It offers an entry level free plan aimed at smaller or growing companies that need an affordable billing solution.

Company specificities:

- They emphasise ease of setup which makes the platform appealing for teams without dedicated billing engineers.

- The product offers a wide feature set at a relatively low cost which positions it as a budget friendly option for small businesses.

- It forms part of a broader system that also includes tools for lead generation which gives it a hybrid nature beyond pure billing.

- Reviews suggest the platform is still evolving which means occasional bugs or missing features compared with more mature billing tools.

🇮🇳 Ind – PreSeed

What they do:

- They provide a payments and billing platform for SaaS, AI and digital product companies. It supports subscriptions, usage based pricing and one time charges.

- They act as a global merchant of record which means they handle payment acceptance, currency conversion and revenue settlement on behalf of the seller.

- They take care of global compliance, tax handling and fraud checks so companies can sell internationally without building that infrastructure.

- They offer fast onboarding so businesses can start accepting payments quickly without creating their own payment stack.

Company specificities:

- Their merchant of record model removes tax registration and compliance burdens from the customer which is uncommon among billing tools.

- They focus on modern monetisation models such as usage based billing and AI driven pricing rather than classic seat based subscriptions.

- Their pricing structure is pay as you go which suits early stage or fast growing digital businesses that avoid fixed monthly fees.

- They are tailored for purely digital goods and software which makes them a good fit for online platforms rather than physical product sellers.

What they do:

- They provide a micro billing system for SaaS and API companies. It lets businesses charge extremely small amounts for each request or action.

- The platform allows providers to set a spending limit for each customer and then charge based on real usage within that limit.

- Customers accumulate usage charges and settle their balance on a monthly cycle while the provider receives payouts.

- It is built for products where fine grained billing is needed and where each request has a measurable cost.

Company specificities:

- They support ultra small billing units down to a tiny fraction of a dollar which most billing systems cannot handle.

- They focus on micro billing and metering rather than offering a full subscription or quote to cash stack.

- They allow dynamic pricing at the request level instead of relying on tiers or flat usage buckets.

- They let providers keep control of their payment accounts while using the platform as the usage rating layer.

🇸🇰 Slo

What they do:

- They provide a platform for B2B SaaS companies that unifies quoting, billing, invoicing, tenant provisioning and analytics. It acts as a single system for revenue operations.

- The platform supports recurring and usage based pricing, tiered models, volume models and custom product catalogues.

- Sales teams can create complex quotes for multi year deals with discounts or ramps and the system then automates billing and renewals.

- It offers real time dashboards for trials, revenue, retention and collections which gives teams a shared view of business performance.

Company specificities:

- The founders have direct experience with running large scale SaaS subscription operations which shapes the product’s focus.

- They position the platform as an all in one revenue operations suite rather than a simple billing tool.

- It is built for modern SaaS companies that need agility in pricing, quoting and renewals across both product led and enterprise sales motions.

- They emphasise data accuracy and unified workflows so billing, invoicing and analytics live together in one environment.