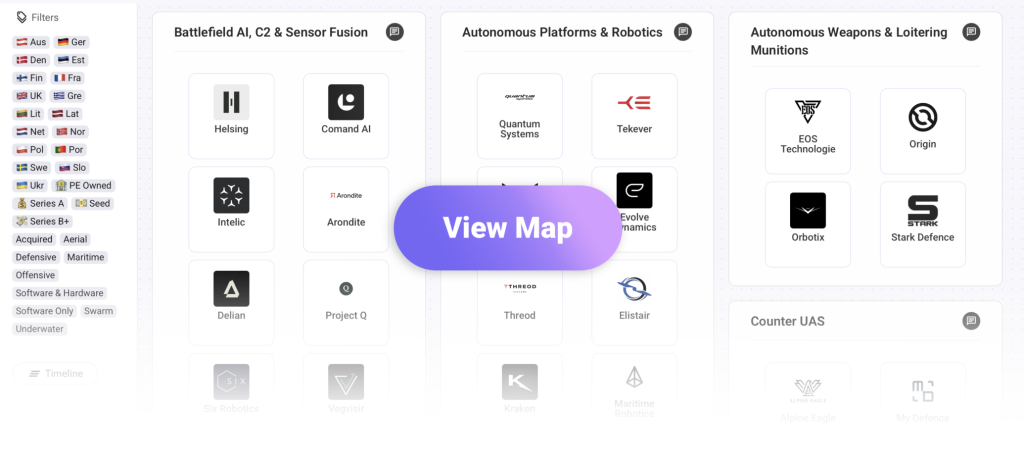

This post is part of a series covering the 🇪🇺 European defence startup landscape. You can view the full interactive map with more than 60 startups here.

What are counter UAS / UAV startups?

- UAV: Unmanned Aerial Vehicle

- UAS: Unmanned Aerial System

- CUAS / C-UAS: Counter Unmanned Aerial System

Counter UAS is the act of identifying and neutralising unauthorized or hostile drones through sensors, electronic measures, capture systems or directed energy.

In that perspective we can distinguish two phases:

- The detection phase a.k.a how to detect incoming drones / UAS.

- The interception phase a.k.a how neutralize them.

Traditionally this is how it is done:

Detection phase:

- Visual observation by humans using binoculars or spotters to spot and report suspicious aircraft.

- Video camera systems that use motion detection and computer vision models to classify objects as birds or aircraft or drones.

- Thermal imaging that picks up heat signatures for night or low visibility detection.

- Radar that scans low altitude airspace and tracks small targets by reflecting radio waves off their frames or rotors.

- Acoustic sensors that listen for drone motor signatures and estimate direction of arrival from sound patterns.

- Radio frequency monitoring that detects and triangulates control and telemetry signals emitted by consumer and tactical drones.

- Sensor fusion where data from cameras, radar, acoustic arrays and RF detectors are combined to reduce false alarms and improve tracking.

Interception phase:

- Radio frequency jamming that disrupts the control link or GPS signals so the drone loses navigation or returns to home.

- GPS spoofing that feeds false positioning signals to confuse the drone about its location.

- Kinetic capture using nets deployed from other drones or from ground launched projectiles to physically seize the intruding drone.

- Directed energy such as high power microwave or laser to disable electronics or burn critical components.

- Offensive drone interception where an interceptor drone approaches and forces the intruder down by collision avoidance pressure or by boarding it.

Emerging challenges & solutions in the counter UAS field

- Fiber-optic control links: some Russian systems now control drones through spooled fiber cables instead of radio links, making them immune to RF jamming or spoofing since no wireless signal is transmitted.

- Pre-programmed or autonomous drones: many drones can now fly fully offline using GPS waypoints or visual navigation, removing the need for any radio control that traditional RF based detection relies on.

- Swarm tactics: China and others are experimenting with coordinated swarms of hundreds or even thousands of drones that can overwhelm radar coverage, confuse AI detection models and exhaust kinetic interceptors.

- Miniaturisation: very small drones with low radar cross sections and weak heat signatures can pass under radar or thermal thresholds, especially when flying low or in cluttered terrain.

- Electronic camouflage: some systems hop frequencies, encrypt telemetry or mimic civilian Wi-Fi or LTE signals to hide inside normal spectrum activity.

Why traditional counter UAS can struggle:

- RF jamming and spoofing are ineffective when drones use fiber links or fly fully autonomously.

- Radar and thermal detection can be saturated or blinded by large swarms or very low-flying drones.

- Kinetic or net interceptors cannot scale economically against dozens or hundreds of simultaneous targets.

- Manual visual spotting or acoustic detection cannot keep pace with silent or massed micro-drones.

New approaches emerging:

- AI driven multi sensor fusion using radar, EO/IR, acoustic and optical data to classify and prioritise threats automatically.

- Directed energy systems such as high power microwaves that disable multiple drones at once within a cone of effect.

- Drone on drone interception swarms where defensive drones coordinate autonomously to intercept incoming swarms.

- Electronic warfare systems that target not the drone itself but its supporting infrastructure such as ground stations, repeaters or GNSS signals.

- Networked C-UAS architectures where multiple sites share sensor data and threat intelligence to cover larger regions.

10 European Defence Startups Developing Counter UAV & Drone Defense Systems

🇩🇪 Ger – 💵 Seed

What they do:

- Alpine Eagle develops the Sentinel airborne counter UAS system, which is a network of air-to-air sensors and interceptors (basically aerial drones) designed to detect, classify, and intercept unmanned aerial systems such as drones, micro UAVs, and loitering munitions.

- The system relies on edge computing, onboard AI, and sensor fusion between active and passive sensors. It is built for mobility and can protect moving units, convoys, or fixed assets from aerial threats.

How they differentiate:

- Their airborne approach provides better visibility compared to traditional ground based anti drone systems (useful in complex terrain).

- The platform emphasizes high automation, allowing a single operator to command a coordinated defensive swarm of aerial sensors and interceptors.

- The system’s scalability, redundancy, and edge processing design make it suited for demanding or mobile missions

🇩🇰 Den – 🏦 PE Owned

What they do:

- MyDefence provides counter UAS solutions that detect, track, identify and neutralise hostile drones by combining RF sensors, jamming technology, software and situational-awareness integration.

How they differentiate:

They offer three distinct solutions:

- Man (wearable): Their soldier kit is a lightweight, wearable counter drone system designed for troops, enabling front line protection with low size/weight/power.

- Vehicle: Their vehicle solutions can be mounted on any armored vehicles, delivering drone defense while on the move.

- Fixed (site/perimeter): They offer fixed site/perimeter C-UAS installations for protecting infrastructure, bases and critical assets.

🇫🇷 Fra – 💵 Seed

What they do:

- Design and deliver end-to-end anti drone solutions that secure low altitude airspace by detecting, characterising and neutralising unauthorized drones via radio frequency technologies.

How they differentiate:

- In-house development from detection sensors through jamming and neutralisation enables full stack control.

- Their main differentiation lies in their advanced jamming capability, which uses precision RF interference to selectively disrupt the communication link between a drone and its pilot.

🇬🇧 UK

What they do:

- Roark Aerospace develops autonomous defence systems that detect, identify and neutralise drones using AI-powered sensors, hyperspectral imaging and real-time decision software.

- They provide detection and defence as a service through a global network of connected sensors that deliver continuous drone monitoring and protection for military and critical infrastructure sites.

How they differentiate:

- Their Detection Network as a Service (DDaaS) model enables clients to access a global network of passive radar sensors on a subscription basis, eliminating upfront capital expense and offering immediate drone-detection coverage.

🇬🇧 UK

What they do:

- They design and manufacture autonomous surveillance and air-defence systems including modular optical payloads for detection, identification and tracking of aerial threats.

- They also develop physical capture systems (for example net-launch systems) as part of their counter-UAS capability, offering a “hard-stop” kinetic option to complement sensor suites.

How they differentiate:

- Their product line emphasises both sensor and interceptor integration: for example optical systems like “Vision Flex” or “Vision Pace” are designed to work with mobile and vehicle-mounted platforms, while the net capture solution (Skywall patrol) addresses scenarios where jamming or spoofing is not sufficient.

- They offer modular architecture where third party sensors or effectors can be integrated via a common interface.

🇸🇪 Swe

What they do:

- NAD develops the “Kreuger 100”, a compact dual use drone interceptor platform that blends hardware and software to intercept aerial drones.

How they differentiate:

- They replace traditionally expensive guided missile or interceptor systems with a sophisticated low cost drone interceptor.

- Their product is developed to ensure European supply chain independence and strategic autonomy, positioning it as a home-grown solution in contrast to many legacy systems reliant on non-European components.

- The Kreuger 100’s can be used for civil usage scenarios, extend their addressable market.

🇪🇪 Est

What they do:

- Provide turnkey autonomous surveillance systems combining AI-powered detection, automated towers or mobile platforms and remote monitoring stations.

- Deliver counter-UAV (C-UAS) and ultra short range air-defence systems (e.g., the EIRSHIELD platform) capable of detecting, tracking and jamming drones via RF/GNSS disruption and interceptor drones.

How they differentiate:

- Their solutions emphasise full autonomy and rapid deployment: platforms like SurveilSPIRE enable long endurance, remote or unattended operation, reducing manpower requirements.

- They target multiple markets (border security, law enforcement, environmental monitoring) beyond purely military.

🇫🇷 Fra – 💵 Seed

What they do:

- They develop AI-powered computer vision solutions that run on the edge to detect and track objects via drone mounted sensors.

- They serve both military and industrial markets, providing real-time detection for battlefield recognition, infrastructure inspection, and surveillance missions.

How they differentiate:

- Their platform emphasises edge AI that works without continuous cloud connectivity, enabling real-time autonomous recognition in contested environments.

🇵🇱 Pol

What they do:

- MADDOS develops and markets anti-drone systems (C-UAS) that combine multiple sensor types to detect, classify and track UAV threats. From passive radio frequency detection, 4D radar, to electro-optical/infrared (EO/IR) cameras.

- They also provide counter measures including jamming (communication/GNSS interference), GNSS spoofing, drone takeover capabilities and command & control (C2) software.

How they differentiate:

- Their solution emphasises full stack integration: detection (passive RF, radar, EO/IR) + command & control + active counter-measures (jamming, spoofing, takeover) in one ecosystem rather than piecemeal modules.

- The C2 software allows users to integrate customer sensors or third-party devices via API and uses NATO symbology, enabling use in military and civilian contexts with a unified operator interface.

🇬🇧 UK

What they do:

- Develop interceptor missiles and air defence systems designed to counter drones and cruise missiles.

- Build domestic manufacturing capabilities for propulsion and radar components to strengthen European supply chains.

How they differentiate:

- Focus specifically on European air and missile defence rather than broad defence tech.

- Control key components like propulsion and radar in-house to ensure performance and security.

- Supported by strong early funding and a team with deep aerospace and academic expertise.

🇩🇪 Ger

What they do:

- Develop autonomous interceptor drones for counter drone missions targeting hostile UAV threats.

- Produce launch systems and supporting hardware to deploy interceptors quickly and at scale.

How they differentiate:

- Focus on cost effective kinetic interception rather than expensive missiles, aiming to keep the cost per engagement low.

- Leverage AI computer-vision autonomy and rapid deployment capability to operate in contested environments.

- Use lightweight, agile platforms (e.g., high speed interceptor with ~15–20 km range) tested in real-world settings including Ukraine.

🇦🇹 Aus – 💵 Seed

What they do:

- Develop electronic warfare systems focused on GNSS protection and disruption.

- Provide long-range GNSS jammers for denying satellite navigation signals across wide areas.

- Offer resilient GNSS receiver IP and sensors designed to withstand jamming and spoofing.

How they differentiate

- Specialise narrowly on GNSS and spectrum warfare rather than broad defence hardware.

- Deliver rapid deployment jamming systems with wide area coverage suitable for contested theatres.

- Combine offensive tools and defensive receiver technology to provide a full spectrum GNSS capability.

🇪🇪 Est – 💰 Series A

What they do:

- Build affordable missile systems designed to counter drones and aerial threats.

- Develop AI powered situational awareness software to improve detection and targeting.

- Focus on scalable production to meet the growing demand for modern air defence.

How they differentiate:

- Aim to make missile systems significantly cheaper and faster to produce than traditional manufacturers.

- Combine deep defence experience with industrial scale manufacturing expertise.

- Strengthen European and NATO supply chains by operating across the Baltic region.