A lost race already?

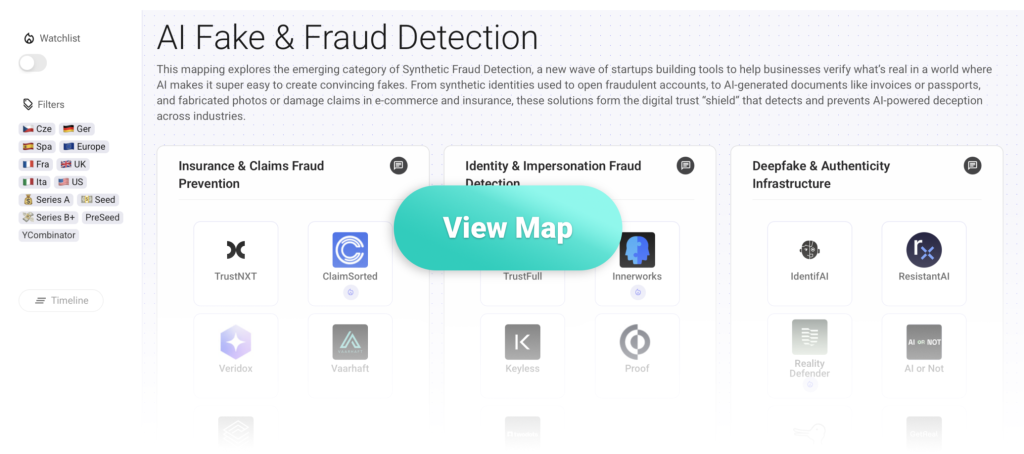

From fake identities used to open fraudulent accounts, to AI generated documents like bank statements and fabricated photos or damage claims in e-commerce and insurance, these solutions provide the digital “trust shields” that aim to detect AI powered fraud.

Insights

Here are a cuple of insights and thoughts about this space:

- Fake digital content is exploding, and fraud is rising at every level. We talk a lot about AI slop flooding the content world, with tsunamis of AI generated videos on YouTube Shorts, TikTok or now Sora. Yet in parallel, AI content is used in fraud: deepfake videos to scam people into wiring money, AI generated bank statements or identity papers to open financial accounts, or fake photos to file fake insurance claims. And no type of digital content will be spared.

- The AI powered fake and fraud detectors: a nascent category. A fresh generation of companies is emerging to tackle this problem. They build detection tools that analyze content inconsistencies, cross-check signals, verify liveness, and ensure documents are real and present. As the mapping shows, out of 29 companies only 4 have made it to Series B or beyond, so we’re just at the beginning.

- A hard problem to solve. This sector is defined by a never ending race as GenAI keeps improving its synthetic output. Detecting fake content becomes tougher day after day (remember those charming six fingered folks 😅). But false positives also create problems too when authentic content is flagged as fake. Big uncertainty remains on what tech approach can actually work.

- Funding is just beginning to flow. Out of the 29 companies on this map, 17 raised a round in 2025 alone. VC interest is starting, and significant acquisitions have not happened yet.

- Verticalized plays or horizontal picks and shovels. Looking at the startups on the map, you basically have two main approaches: You can go vertical with tailored fraud detection products (next-gen AML for banks, AI-claims fraud prevention for insurers, etc). Or you can become the picks and shovels provider by giving developers the detection tools they can embed everywhere.

- A lost race? A big question for me is whether the battle is even winnable. As Jensen Huang said, at some point every pixel will be AI generated. So does it even make sense to chase fake versus real, or do we need a completely new model to operate in this world? Maybe insurers stop relying on pictures and verify damage in other ways. Maybe fintechs never accept user uploaded documents again but fetch verified data from trusted sources only. The shift could be systemic, not just defensive (happy to have your thoughts on this one).