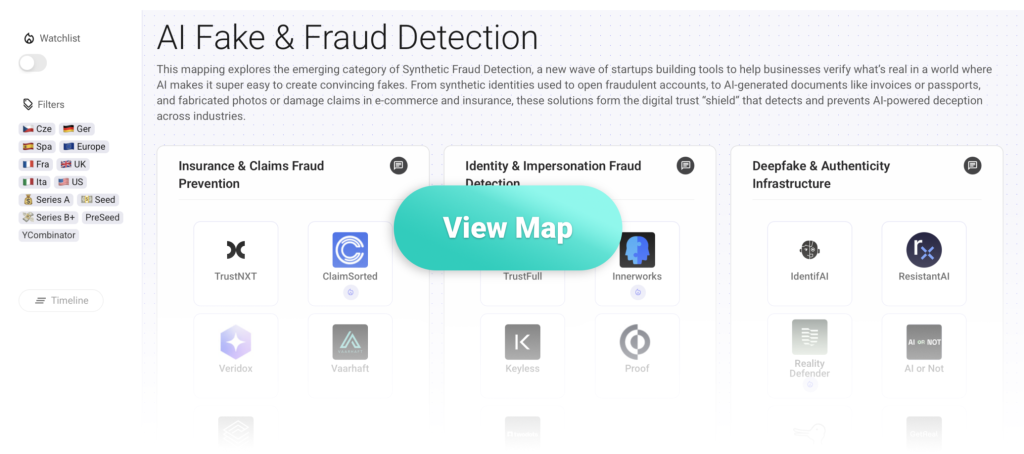

This post is part of a series covering AI fake & fraud detection startups. You can view the full competitive landscape with more than 35 startups here.

This competitive mapping explores the emerging category of Synthetic Fraud Detection, a new wave of startups building tools to help businesses verify what’s real in a world where AI makes it super easy to create convincing fakes. From synthetic identities used to open fraudulent accounts, to AI-generated documents like invoices or passports, and fabricated photos or damage claims in e-commerce and insurance, these solutions form the digital trust “shield” that detects and prevents AI-powered deception across industries.

What new types of fraud has GenAI introduced in the insurance industry?

- Generative AI now enables anyone to fabricate convincing photos of car crashes, property damage, or health related incidents, making false claims look authentic.

- Fraudsters use AI tools to forge invoices, repair estimates, and official documents that easily bypass legacy verification systems.

- Deepfake videos and voice cloning are used to impersonate policyholders or witnesses during remote assessments.

- The sheer scale and automation of these fabrications overwhelm human reviewers, increasing false payouts and eroding trust in digital claims processes.

- Traditional fraud models, which rely on rule based filters or historical patterns, struggle to detect synthetic data because these fakes mimic genuine signals too well (and it’s a never ending race).

What are the major approaches used by startups to counter it?

- Applying computer vision and forensic AI to analyze image and video metadata, texture inconsistencies, and generation artifacts invisible to the human eye.

- Authenticating the provenance of visual and document evidence using cryptographic watermarking, digital signatures, or blockchain anchoring.

- Comparing new claims data against trusted datasets and cross source validation signals to detect anomalies or synthetic overlaps.

- Introducing continuous trust scoring systems that assess the authenticity level of each claim element instead of binary “real/fake” checks.

- Automating large parts of the verification workflow so insurers can filter out low trust claims early and focus human expertise where it matters most.

5 Startups in the Insurance & Claims AI Fraud Prevention

🇩🇪 Ger – 🇪🇺 Europe – 💵 Seed

What they do:

Provide a platform that ensures the authenticity of visual evidence (photos/videos) and documents by embedding cryptographic “trust labels” and proof of origin to prevent manipulated images in insurance claims.

How they differentiate:

Focuses on tamper proofing multimedia evidence with an end-to-end chain of custody and proof of origin aimed at both insurers and machines, not just anomaly detection.

🇪🇺 Europe – 🇬🇧 UK – 💵 Seed

What they do:

An AI-first Third-Party Administrator (TPA) that automates the claims lifecycle, including fraud checks, compliance and payouts, turning claims into faster, data-driven processes.

How they differentiate:

Combines automation for speed (e.g., payouts in minutes) with embedded fraud detection and real-time data insights in a white-label service for insurers.

🇪🇺 Europe – 🇬🇧 UK – PreSeed

What they do:

Offer a forensic AI platform that analyses images and documents in insurance claims to detect manipulations (e.g., doctored PDFs, edited photos) and provide contextual, explainable reasoning behind fraud flags.

How they differentiate:

Goes beyond flagging anomalies and provides explainable AI that shows exactly what was manipulated and why, supporting litigation or deeper investigation.

🇩🇪 Ger – 🇪🇺 Europe – PreSeed

What they do:

Deliver a modular API based computer vision/forensic AI solution for detecting fake or manipulated digital claim images and reducing image based insurance fraud.

How they differentiate:

Specifically targets image based fraud with deep learning, metadata checks and duplicate image detection, tailored for the German insurance market and designed for integration via API into claims workflows.

🇪🇺 Europe – 🇫🇷 Fra – 💵 Seed

What they do:

Provide a digital proofing platform that certifies photos and videos at the point of capture (geolocation, timestamp, digital seal) and creates legally admissible, tamper proof evidence for insurers and large scale claims handling.

Main differentiations:

Emphasises legal grade certification of visual evidence (eIDAS compliant in EU) at capture time rather than only post fact manipulation detection, turning claim evidence into trustable digital assets.