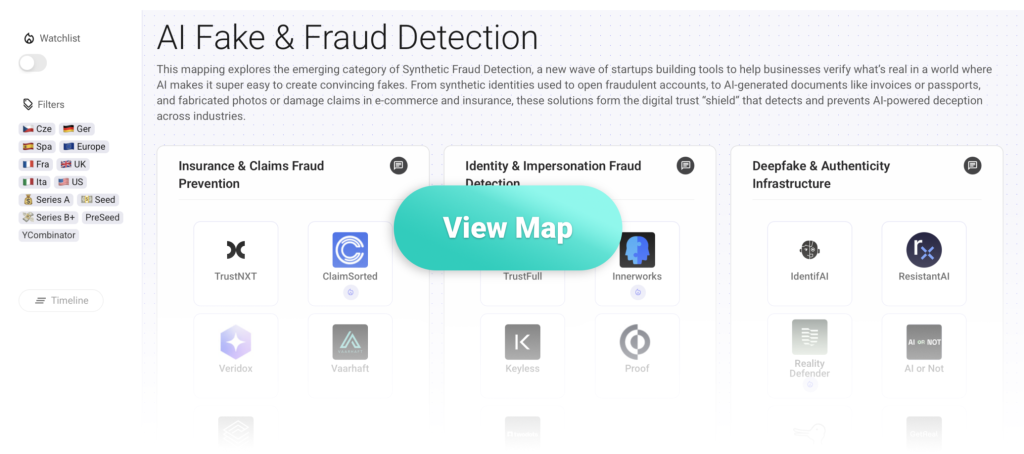

This post is part of a series covering AI fake & fraud detection startups. You can view the full competitive landscape with more than 35 startups here.

This competitive mapping explores the emerging category of Synthetic Fraud Detection, a new wave of startups building tools to help businesses verify what’s real in a world where AI makes it super easy to create convincing fakes. From synthetic identities used to open fraudulent accounts, to AI-generated documents like invoices or passports, and fabricated photos or damage claims in e-commerce and insurance, these solutions form the digital trust “shield” that detects and prevents AI-powered deception across industries.

What new types of risk has GenAI introduced in the identity space?

- Deepfake technology allows anyone to mimic faces, voices, and identities. Digital impersonation is now accessible to non technical people.

- Synthetic identities (blends of real and fake data) are used to open accounts, pass KYC checks, or bypass biometric verification.

- AI-generated ID photos, passports, and video selfies now fool legacy verification systems that were built to detect human made fakes.

- Voice cloning enables real-time impersonation in customer support or banking verification calls, creating a new layer of social engineering risk.

What are the major approaches used by startups to counter it?

- Developing deepfake resistant biometrics that analyze facial micro-movements, depth patterns, or reflection cues which are difficult to fake consistently.

- Performing active liveness checks, prompting users to react in real time or respond to dynamic challenges to prove physical presence.

- Using cross signal intelligence, combining data from device fingerprinting, voice patterns, behavioral analysis, and session metadata to detect anomalies.

- Employing forensic AI a.k.a tracing subtle generation artifacts or inconsistencies across frames, pixels, and audio frequencies.

- Building continuous identity assurance systems that verify authenticity not just once during onboarding but throughout a user’s lifecycle.

5 Startups in the Identity & Impersonation Fraud Detection

🇪🇺 Europe – 🇮🇹 Ita – 💵 Seed

What they do:

Trustfull offers a fraud prevention platform that analyses hundreds of digital signals (phone number, email, IP, device, domain, etc.) in real time to assess user risk for KYC/KYB/AML workflows.

How they differentiate:

Instead of just document or biometric checks, Trustfull operates silently in the background using open source intelligence and digital footprint signals to flag synthetic identities or impersonation without friction.

🇪🇺 Europe – 🇬🇧 UK – 💵 Seed

What they do:

Innerworks provides a platform of “Synthetic Threat Intelligence” that simulates AI-driven fraud attacks (deepfakes, bots, impersonation) and detects them via device fingerprinting, behavioural signals and adversarial testing.

How they differentiate:

The company emphasizes proactive adversarial simulation (using generative models and red team style ethical hacking) to build defenses specifically against AI-driven impersonation/fraud rather than only reactive detection.

🇪🇺 Europe – 🇬🇧 UK – 💵 Seed

What they do:

Keyless offers privacy-preserving biometric authentication that binds both the user’s face and their device (and includes liveness and deepfake/attack detection) to prevent account takeovers and deepfake-based spoofing.

How they differentiate:

They combine multi-factor biometric plus device binding with zero biometric data storage (privacy by design) and explicitly target deepfake and injection attacks.

🇺🇸 US

What they do:

Proof offers an identity and transaction security platform that verifies identities, authenticates interactions and secures digital records (documents, images, videos) including deepfake-aware features.

How they differentiate:

They recently launched a product (Certify) that uses cryptographic signatures and a chain of trust to ensure the authenticity of media/records and guard against AI-generated impersonation/content, positioning themselves as the “digital identity chip” for modern fraud.

🇺🇸 US – PreSeed

What they do:

Two Dots is an AI-powered underwriting and fraud prevention platform that automates identity & income verification for lenders, detects fraud in applications and streamlines decisioning.

Main differentiation:

While not strictly focused on deepfake biometrics, their specialisation in automating underwriting and fraud detection for new consumer applications allows them to spot identity/fraud patterns early in the lifecycle and reduce manual review for fintech/insuretech.