How GenAI is adding new layers of complexity to pricing and billing

The billing tech space (software and tools that help businesses manage pricing and billing) is an interesting one because it illustrates well second order effects of AI in the software industry.

Since the rise of the SaaS model, businesses have used products to manage their subscriptions, invoices and pricing models. These tools were often bundled within payment providers like Stripe Billing or offered by third party platforms such as Zuora.

But because of GenAI the market is changing fast. AI in software introduces new complexity through usage based consumption where the cost to deliver a software depends on the user’s token usage rather than a simple subscription model based on seats or tiers. Knowing that the price of LLM APIs also changes regularly, you can imagine how difficult it becomes to manage pricing and billing.

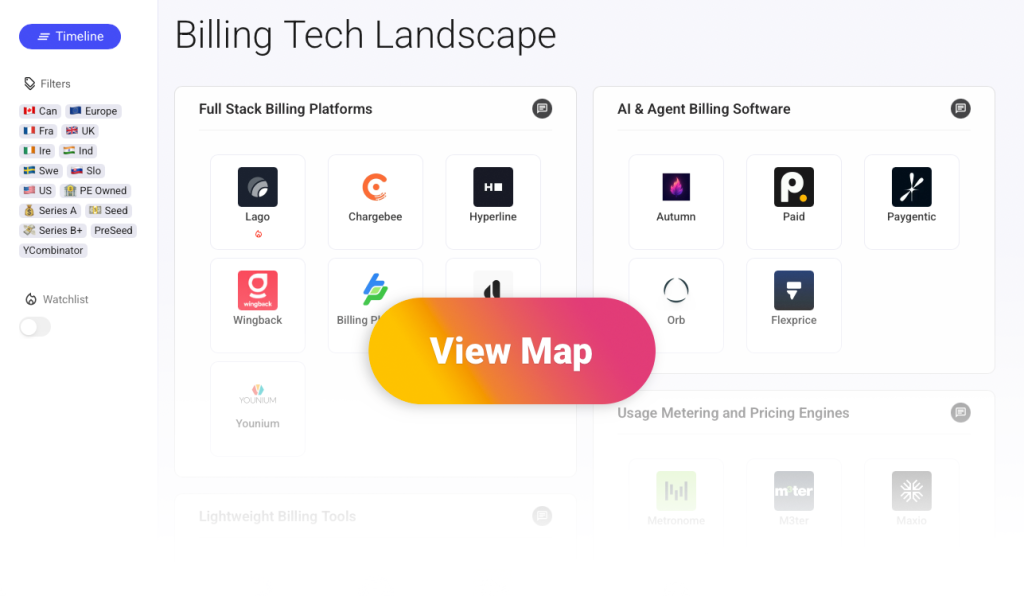

Token consumption brings new challenges and needs, and a new generation of billing tech companies is emerging to address them. I mapped around 20 billing tech software companies in this landscape.

Here are six Insights from searching for this competitive landscape:

- #1 The seven functions of billing tech. At a high level, the scope of billing software evolves around seven main functions:

- Subscription lifecycles: Create plans, manage upgrades or downgrades, control renewals and deal with cancellations.

- Invoicing and payments automation: Generate invoices, collect payments, manage taxes and support multiple currencies.

- Pricing models management: Support subscriptions, seat based pricing, usage add ons and hybrid models in one system.

- Usage metering: Ingest raw product events, validate them, enrich them and aggregate them into a clean usage stream that billing and pricing systems can rely on.

- Customer accounts management: Track contracts, balances, credits and customer history across billing periods.

- Finance and CRM systems integration: Sync with ERPs, accounting software and CRM tools to close the loop between sales, billing and finance.

- Revenue workflows: Support revenue recognition, dunning, collections and audit trails needed for compliance.

- #2 Four categories of billing tech startups. My map categorization is probably not perfect, but looking at the different players I found, I ended up with four main categories:

- Full stack billing software: These products cover the entire scope and tend to serve larger companies.

- Billing software for AI native products: The latest generation of billing startups built for AI native products with needs tied to tokens and agent workloads.

- Usage metering and pricing engines: These companies focus on the “plumbing layer”. They ingest usage & billing related events to validate, enrich and aggregate them into a clean stream of data.

- Lightweight billing tools: Simplified versions of full stack platforms with fewer features, often aimed at smaller customers such as small businesses or freelancers.

- #3 GenAI has created new pricing and billing needs. AI native products and agents rely on pricing structures driven by token consumption rather than fixed tiers or seats. Their costs change with usage, and the underlying AI model prices (ChatGPT, Gemini…) also change frequently, which adds more complexity to how these startups price and manage their product.

- #4 Pricing and billing are becoming critical for AI startups. Token consumption directly shapes cost structure and margin. Traditional subscription models came with predictable margins while token based models move in real time and can make or break a company if not properly managed. Billing is becoming a core function for AI startups rather than an afterthought.

- #5 A market with higher barriers to entry. Unlike categories where dozens of startups appear quickly (like in the AI receptionist space), billing tech has higher barriers to entry. First, products are complex because they require many features and involve sensitive payment flows. Second, user adoption is also harder since businesses do not test billing systems every week and switching from an existing solution is difficult once it works well enough (hard to replace an existing billing solution).

- #6 VCs are actively investing in the space. Out of the 21 startups on the map, 8 have raised a round in 2025 and most startups listed are VC backed (the exemptions are mostly in the lightweight billing software category btw).

Conclusion

I think billing tech is a good example of second order complexity that emerges when major new technologies appear. To take another example, computers and spreadsheet software did not simplify accounting. They actually made it more complex and created a new set of needs around it. The same will happen with AI.