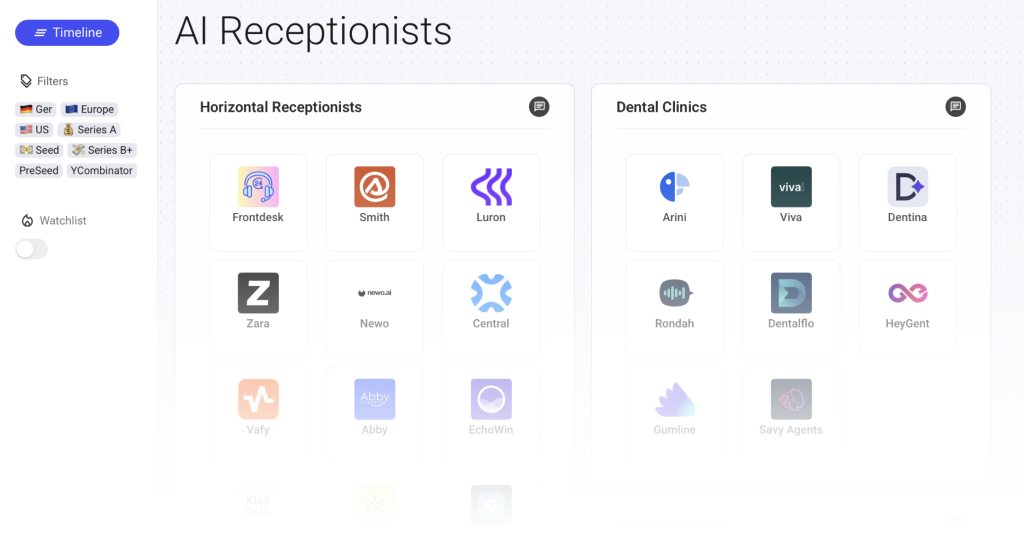

This post is part of a series covering the AI receptionist market. You can view the full interactive competitive landscape with more than 70 startups here.

This map covers the emerging (and already competitive) landscape of AI receptionists startups powered by GenAI that autonomously answer inbound calls, book, route, or screen them, and integrate with calendars and CRMs. These products act as always on voice agents for businesses that depend on phone interactions to capture leads or serve customers.

AI Receptionists for Financial & Insurance Services

Insurance & financial fields calls for quotes, claims, and renewals. AI receptionists focus on verifying identity, capturing claim or policy details, and routing to agents, while ensuring compliance and secure data handling.

Is the receptionist a cost or a revenue center?

In insurance and financial services, the receptionist plays a dual role as both cost and revenue center. A significant share of inbound calls are revenue-related (such as new policy inquiries, loan applications, or potential client consultations) where responsiveness can directly impact conversion. At the same time, a large portion involves ongoing client servicing, including claims, renewals, account updates, and compliance questions, which are operational but critical for retention. Because of this blend, the receptionist function is tightly linked to both acquisition and lifetime value.

Who, in the business, is traditionally answering the calls?

Traditionally, administrative staff, licensed agents, or financial advisors handle incoming calls, depending on the nature of the inquiry. In smaller firms, it’s often the owner or a senior advisor who answers directly, balancing client service with business development. This mix means AI receptionists can unlock significant value, not just by saving time, but by ensuring every revenue opportunity is captured and no client communication falls through the cracks.

What is the depth of the post-call actions?

Post-call actions in this vertical are often deep and complex, extending well beyond appointment scheduling. Calls may trigger identity verification steps, document collection, regulatory compliance workflows, CRM updates, or internal approvals. In many cases, the follow-up involves sensitive financial or personal data, requiring strict security and privacy handling. The AI receptionist must therefore integrate tightly with back-office systems and support structured handoffs into these regulated workflows.

2 Startups Creating AI Receptionists for Financial & Insurance Services

🇺🇸 US – PreSeed

What they do:

- The product is an AI receptionist designed for insurance agencies. It answers calls instantly with personalised and multilingual support at any time of day.

- It collects information for quotes by gathering policy details from callers and sending that data into the agency’s management system.

- The system also handles servicing needs such as claim status updates, renewals and appointment scheduling while routing urgent calls to human agents.

- After each call it creates summaries, extracts key data and updates the CRM or agency management system so follow up actions are always tracked.

Company specificities:

- The company focuses entirely on the insurance sector which makes its workflows and language tailored to agency needs.

- It integrates with common agency management systems so data flows smoothly from caller to back office.

- The solution offers round the clock availability, multilingual support and simultaneous call handling so leads are not lost after hours.

- Their messaging emphasises that the AI supports human agents by removing routine tasks and letting them focus on revenue opportunities and client relationships.

🇺🇸 US – 💵 Seed

What they do:

- The product is an AI assistant built for financial services and insurance firms. It works across voice, chat, text, email and WhatsApp and stays available at any time.

- It captures leads by booking appointments, qualifying prospects and collecting policy or account details.

- It supports customer service by answering questions about billing, claims, renewals and general account information.

- It also offers AI tools that summarise documents, extract insights and help teams stay organised and compliant.

Company specificities:

- The company designs the product specifically for insurance and financial services which means the workflows, guardrails and vocabulary reflect industry needs.

- The system supports many communication channels and languages which helps firms reach clients in the way that suits them best.

- Strong focus on compliance and data security includes audit trails, access controls and industry specific safeguards.

- The product is positioned as both an efficiency tool and a revenue enabler by improving lead conversion, reducing churn and supporting upsell opportunities.